It's Never the Wrong Time to Hire the RIGHT Expert

Property Loss & Cost Analysis Services

Request a Free Consultation

Serving Independent and Impartial Building Consultant Services to:

Insurance Companies, Policyholders, Plaintiff Attorneys, Defense Attorneys, Property Managers, and Mortgage Holders

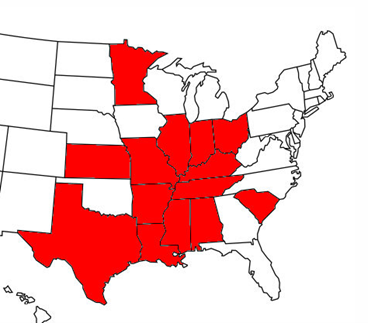

Offering Expert Building Consultant Services Nationwide with recent assessments in:

AL, AR, IL, IN, KS, KY, LA, MN, MO, MS, OH, SC, TN, TX

Expert & Impartial

Our Services

Expert Building Consultants

When a property loss occurs, there can be many professionals involved in the claim settlement and restoration process. Insurance companies utilize building consultants to streamline the inspection and estimating process. Building consultants often evaluate the measure of damage that the insurance company utilizes for settlement purposes. Property owners utilize building consultants to quantify the extent of the damage and verify the repair methodology.

Independent Cost Analysis

Both property owners and insurance companies utilize building consultants to value the measure of damage or amount of loss. Most insurance companies utilize computer estimating software to value property damage. Xactimate by Xactware is typically utilized to estimate property damage claims. Often contractors will utilize a different software program or internal cost structures to value the amount of loss. The team at Omega Building Consultants is certified at the highest level to produce accurate line-item Xactimate estimates. If appropriate, our team can also develop a cost approach valuation that incorporates competitive bids to return the property to its pre-loss condition.

Neutral Appraisal Umpire

Sometimes there is a disagreement over the value of a property loss between the insurance company and the policyholder. When the disagreements cannot be resolved between the two parties, appraisal becomes a viable option. If the claim process reaches a point of dispute and an independent appraiser or neutral umpire is required, please visit our sister company Omega Insurance Appraisals for additional details.

Damage Assessment and Cost Analysis Consulting Firm

Our team of consultants are among the most respected professionals in the industry.

Once we receive your file, you can have confidence your property and interests will be represented with professionalism and expertise.

In 2019, Toby J. Johnson saw a need within the insurance industry for a Building Consulting company that could provide superior results without over-promising and under-delivering. Having worked in the insurance industry for close to 20 years’, Mr. Johnson is frequently called upon to provide expert analysis and testimony across the country. Mr. Johnson has provided expert analysis of causation, repair methodology, and construction costs for complex losses and matters in excess of $50 million. Mr. Johnson has been accepted as an expert witness in both state and federal courts. Mr. Johnson holds a number of licenses and certifications associated with insurance claims and property damage restoration and is accredited as a Continuing Education (CE) Provider by the Florida Department of Financial Services specifically related to appraisal and umpire certification curriculum.

Striving for excellence through integrity, our team of building consultants are among the most respected professionals in the industry. When your file is with Omega, you can have confidence knowing your file will be handled with the utmost professionalism.

Wide Area of Expertise

Projects

Project 1

Location: Lewisburg, Tennessee

Loss Size: 8-Figure

Loss Type: Hail Damage

Property: Distribution Center

Size: 800,000 SF

Project 2

Location: Nashville, Tennessee

Loss Size: 7-Figure

Loss Type: Hail Damage

Property: Condominium Association

Size: 450,000 SF

Project 3

Location: St. Louis, Missouri

Loss Size: 7-Figure

Loss Type: Hail Damage

Property: Commercial Retail Center

Size: 300,000 SF

Project 4

Location: Louisville, Kentucky

Loss Size: 7-Figure

Loss Type: Hail Damage

Property: Commercial Retail Center

Size: 97,000 SF

Project 5

Location: St Louis, Missouri

Loss Size: 7-Figure

Loss Type: Hail Damage

Property: Condominium Association

Size: 300,000 SF

Project 6

Location: St Louis, Missouri

Loss Size: 7-Figure

Loss Type: Hail Damage

Property: Commerical Retail Center

Size: 131,000 SF

Project 7

Location: Nashville, Tennessee

Loss Size: 7-Figure

Loss Type: Hail Damage

Property: Commercial Warehouse

Size: 131,000 SF

Project 8

Location: St Louis, Missouri

Loss Size: 6-Figure

Loss Type: Hail Damage

Property: Religious Institution

Size: 55,000 SF

Project 9

Location: Kansas City, Kansas

Loss Size: 7-Figure

Loss Type: Hail Damage

Property: Commercial Retail Center

Size: 90,000 SF

"The Team of Experts at Omega are outstanding. They helped one of our clients create a cost-efficient maintenance strategy for a very expense roof system that did not require full replacement. The Omega team is our “go-to” for all things roofing.”

Frequently Asked Questions

What is an insurance appraiser?

Insurance appraisers estimate the value of insured items and evaluate insurance claims. They decide whether an insurance company must pay a claim, and if so, how much. Most insurance appraisers work full time. They often work outside the office, inspecting damaged buildings

Search for: What is an insurance appraiser?

What is the appraisal clause?

An appraisal clause is a clause or paragraph found in most but not all insurance policies. It is designed to be a way of reaching a settlement when there is a dispute over the amount of a loss between you and your insurance company and can be invoked by either party.

Search for: What is the appraisal clause?

How much does an insurance appraisal cost?

An average appraisal for a homeowner claim will cost between $1,000 to $3,250. The insured pays the full cost of an appraiser directly hired by the insured. Appraiser fees are $500.00 on the low end and $2,000.00 on the high end. Some appraisers will charge an hourly fee in lieu of a fixed fee.

Search for: How much does an insurance appraisal cost?

What is the Insurance Appraisal process?

Appraisal is a Policy Provision found in the Loss Settlement section. It is an Alternate Dispute Resolution, which can resolve disagreement when the Carrier and Policyholder do not agree on the amount of loss. It is an alternative to a lawsuit. Appraisal does not address coverage issues, but can include or exclude items based on causation depending on the state.

Search for: What is the Insurance Appraisal process?

When is Appraisal Appropriate?

Sometimes there is a disagreement over the insurance company’s valuation of an insurance claim. Policyholders often think the only way to settle the dispute is to hire a lawyer. Fortunately, this is not the case. Appraisal is a method of Alternative Dispute Resolution often found in many homeowner and commercial insurance policies.

The language will often, but not always, state that appraisal is mandatory when properly demanded by the insurer or insured. It is important to have a qualified Appraiser review your policy to determine your options.

Search for: When is Appraisal Appropriate?

Is Appraisal Better than Litigation?

In most cases, appraisal is quick and expedient as compared to legal actions. The cost is significantly less than hiring an attorney as well. When you bring legal action, it may be less adversarial than suing an insurance company

Search for: What is the Insurance Appraisal process?

What if Both Appraisers do not agree?

If the appraisers fail to agree, they will submit their differences to the umpire. An itemized decision agreed to by two of these three will set the amount of loss. Such award shall be binding.

Search for: What if Both Appraisers do not agree?

Do I only pay for my Appraisal if I Win?

Regardless of the outcome, each party will pay its own appraiser and bear the other expenses of the appraisal and umpire equally.

Search for: Do I only pay for my Appraisal if I Win?

What Our

Clients Say.

Certified and Licensed